Beneficial Ownership Transparency 101

Over the past few years, beneficial ownership transparency policies have gained traction around the world. As of 2018, 18 countries had announced commitments to implementing beneficial ownership transparency policies. They include France, Italy, and the United Kingdom. This rapid increase begs a few questions: what is beneficial ownership transparency, what do beneficial ownership transparency policies look like, and why are governments interested in them?

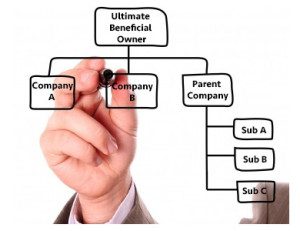

Beneficial ownership refers to the person who ultimately owns or controls an asset and benefits from it. Beneficial ownership and legal ownership are different concepts. For example, if Company X is wholly and legally owned by Company Y, company Y is the legal owner of Company X, while the individuals benefiting from Company Y are the beneficial owners.

Beneficial ownership transparency refers to efforts to make clear who ultimately benefits from legal entities. When beneficial ownership is opaque, individuals can set up shell companies to obscure how they benefit from companies. Politicians may be able to conceal whether they own a stake in companies that stand to gain from new legislation, criminals can launder money, firms can evade taxes, and individuals can finance terrorists. Opaque beneficial ownership harms the private sector by making it hard for companies to understand who they’re doing business with, increasing the cost of due diligence and compliance. Beneficial ownership transparency polices have struck a chord with governments because they can simultaneously combat the financial crimes and improve the business environment by reducing transaction costs and risks.

Beneficial ownership registries are the primary tool governments use to make beneficial ownership more transparent. Registries require businesses to report their beneficial owners and changes in their beneficial ownership. Registries differ in terms of ownership percentage thresholds for reporting, timelines for reporting, approaches to data verification, penalties for failures to accurately report on time, data standards, and who can view the register (law enforcement agencies or the public).

Take the United Kingdom’s register as an example. In 2016, the UK became one of the first countries to create a public beneficial ownership register. The register covers three types of assets—companies, trusts, and properties and land—but only the register of companies is currently available to the public. The United Kingdom requires companies to provide beneficial ownership information once a year when they send in their annual return or “confirmation statement,” and all companies must be registered by 2020.

As of 2018, there are over four million companies on the register. After the register’s first year, Global Witness, DataKind UK, OpenCorporates, Spend Network, and OCCRP analyzed data from the companies that had already registered their beneficial owners and reported on their findings. They found that 3,000 companies had listed their beneficial owners as a company located in a tax haven, which is not allowed, and that 76 of the beneficial owners shared the same name and birthday as someone on the U.S. sanctions list.

The report revealed some relatively easy ways to improve the registry. For example, there were issues with how citizens entered data. People wrote “British” in the nationality box in over 500 different ways. People also made over 2,160 mistakes when inputting birthdays. These problems can be easily fixed by changing the input boxes from open text boxes to drop-down selection boxes.

From the UK experience, there are a number of useful lessons for those countries likely to join the swelling ranks of those nations committed to beneficial ownership transparency. One of the larger challenges faced by governments is data verification. How can countries determine the veracity of the information companies report? What kinds of policies can incentivize compliance? Early adopters of beneficial ownership policies, such as the UK will pave the way, revealing avoidable pitfalls and grappling with larger, more political and expensive challenges. All in all, as the global anti-corruption community continues to grow in scope and vibrancy, beneficial ownership transparency is an essential element.

Caroline Tankersley, Intern, Global, CIPE

Photo credit: Transparint